annual federal gift tax exclusion 2022

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or. In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the.

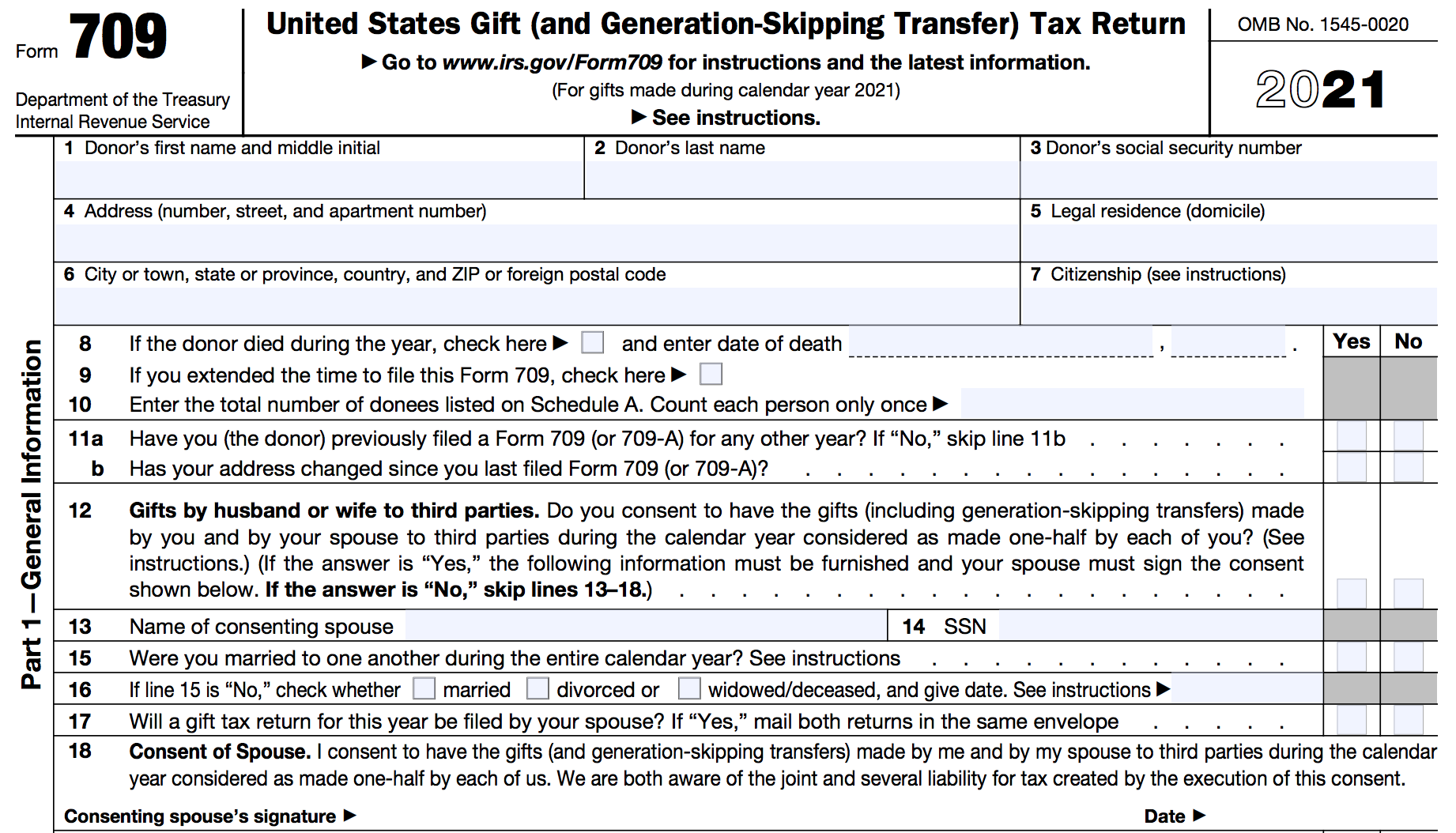

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

The federal estate tax exclusion is also climbing to.

. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. If you managed to use up all of your exclusions you might have to pay the gift tax. Please visit the Estate and Gift taxes page for more information regarding federal estate and gift tax.

The annual exclusion applies to gifts to each donee. The tax applies whether or not the donor. The federal government imposes a tax on gifts.

This means that any individual can give up to 17000 to. If you want to avoid paying the gift tax stay below the annual exclusion amount which is 16000 in 2022 up from 15000 in 2021. Annual Gift Tax Exclusion.

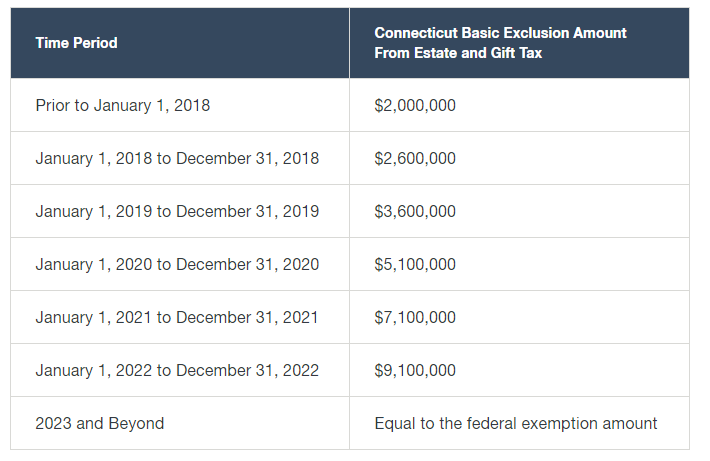

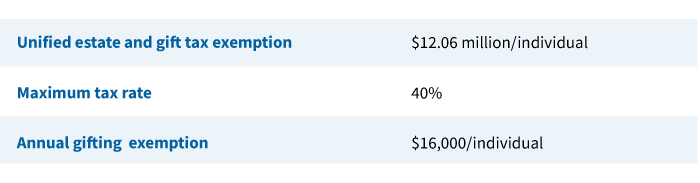

The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021. The IRS also increased the annual exclusion for. In 2022 the annual gift tax exemption is increased to 16000 per.

How the gift tax is calculated and how the annual gift tax exclusion works. The gift tax limit for. Federal Annual Gift Tax Exclusion 2022.

Annual Gift Exclusion. The IRS allows individuals to give away a specific amount of assets or property each year tax-free. In addition to the annual exclusion increase the IRS announced that the federal lifetime gift tax exemption will increase to 12060000 as of January 1 2022.

The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime exemption amount. In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year. The IRS clarified that individuals taking advantage of the increased gift tax exclusion.

As the gift and. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. Wednesday March 2 2022.

In 2022 the annual gift tax exemption is. The term taxable gifts means the total amount of gifts made during the calendar year less the deductions provided in subchapter C section 2522. Like weve mentioned before the annual exclusion limit the cap on tax-free gifts is a whopping 16000 per person per year for 2022 its 15000 for.

Although there is near-universal acceptance. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each.

Moreover the annual gift tax exclusion is set to rise from 16000 per donee in 2022 to 17000 per donee in 2023. Code 2503 - Taxable gifts. Gifts that are worth more than that amount.

The gift tax annual exclusion allows taxpayers to make certain gifts without using their lifetime exemption amount.

Personal Planning Strategies Lexology

What Is The Tax Free Gift Limit For 2022

Warshaw Burstein Llp 2022 Trust And Estates Updates

Gift Tax Exclusion For Tuition Frank Financial Aid

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

2019 Estate Planning Update Helsell Fetterman

Four Estate Planning Ideas For 2022 Putnam Wealth Management

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The Gift Tax Made Simple Turbotax Tax Tips Videos

Federal Annual Gift Tax Exclusion For 2022 Beresford Booth Pllc

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Higher Limits In 2022 Make Gifting Slightly Easier Sol Schwartz

Irs Announces Increased Gift And Estate Tax Exemption Amounts Morgan Lewis Jdsupra